Code Named OPFOPEN Retired FBI Agents Talk About Case

SACRAMENTO–In a salute to Wall Street Journalist JONATHAN KWITNY, in February 1977, the FBI’s Indianapolis Division initiated OPERATION FOUNTAIN PEN, code named “OPFOPEN, Major Case #1,” that targeted professional White Collar Crime [WCC] thieves pedaling “bogus” securities in both the United States and Europe. Ripping off millions, relying on jurisdictional disputes and problems collecting evidence overseas to thwart a number of criminal investigations, conmen had become embolden conducting their scams convincing several juries the complicated transactions were not fraudulent acts, but rather financial disputes between business parties.

But agents thought differently, however, and several suggested using an “insider” to get information while conducting the investigation would solve the problem. Spearheading the effort, the Indianapolis Division launched the OPFOPEN probe. Because KWITNY penned, “THE FOUNTAIN PEN CONSPIRACY,” recommended reading for fraud investigators looking into the murky underworld of international bank swindlers, the operation was code named OPFOPEN.

But Bureau critics suggested scheming bank swindlers represented only half the story. Like Organized Crime in years past, they claimed the FBI was slow investigating White Collar Crime [WCC] because “numbers” dictated how the Bureau investigated some violations. Because increased year-end totals concerning arrests made, cases opened and property recovered meant more funding, critics said the FBI ignored or shied away from the more complicated WCC investigations to work matters that were better suited to support its budget. Consequently, following J. EDGAR HOOVER’s death and the resulting committee hearings on intelligence agency abuses, Congress insisted the FBI realign its investigative priorities—demanding agents pursue a “quality” versus “quantity” approach conducting investigations. Stinging from criticism suggesting agents worked stolen cars cases to inflate recovery amounts and chased military deserters to boost fugitive arrests, the FBI reorganized its case management system and seized the OPFOPEN investigation as evidence the Bureau was complying with their new mandate.

Seeking travel authority, the Indianapolis Division explained the OPFOPEN probe concerned “undercover” agents meeting with swindlers using “bogus” offshore banks to sell securities. The British West Indies—in particular the islands of Montserrat and St. Vincent—had become clearing houses for numerous fraud schemes with conmen stealing millions from duped institutions. Unlike tourists seeking the trade winds, the conmen were using the islands to establish phony banks like the Mercantile Bank & Trust, in Kingstown, St. Vincent—selling bogus Certificates of Deposit [CDs], Letters of Credit [LCs] and other financial instruments to individuals trying to avoid foreclosure or bankruptcy or other scam artists trying to fleece Wall Street.

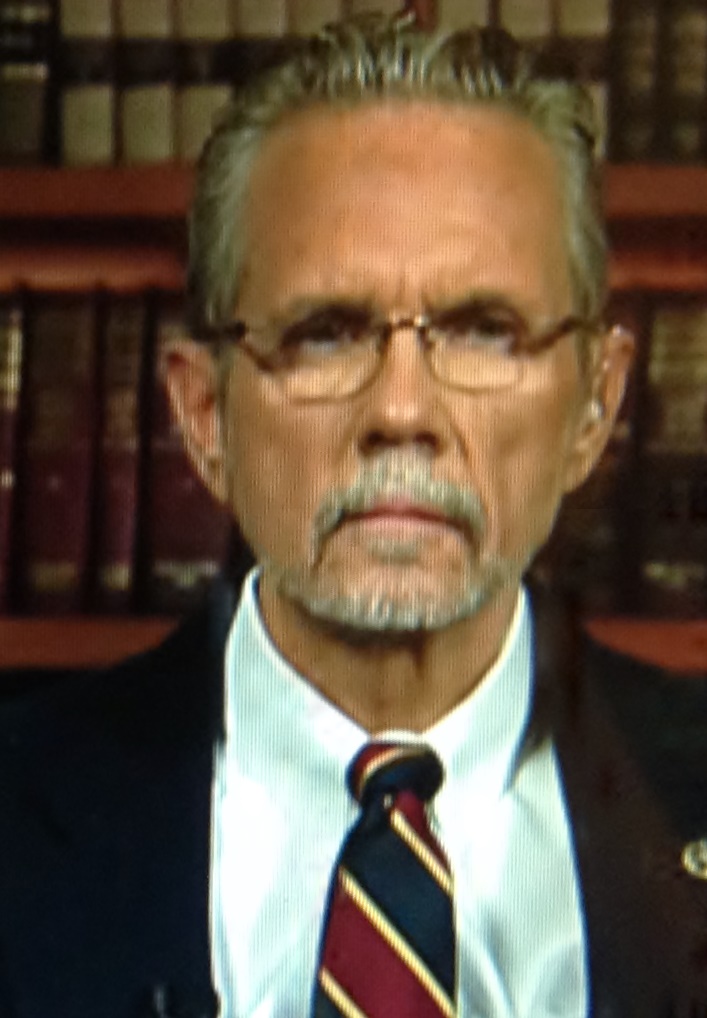

Targeted in the OPFOPEN probe, agents identified PHILLIP KARL KITZER, a principal architect behind many of the scams, as approaching a Bureau confidential informant—claiming he had “paper” for sale. Wanting to make a case, the Bureau authorized Special Agents [SAs] JOHN E. BRENNAN and JAMES J. WEDICK to meet with KITZER to collect evidence. A professional thief, KITZER had numerous organized crime connections and was known to enjoy litigating cases with the Justice Department. Accordingly, the Bureau authorized BRENNAN and WEDICK to travel with KITZER—anywhere in the United States and overseas—in order to build a prosecutable case against him and make others against a select group of conmen financiers known as the, “The FRATERNITY,” responsible for defrauding a number of individuals and institutions throughout the world.

Visiting places such as Paradise Island, Nassau; Tokyo, Japan; Hong Kong; Athens, Greece; Geneva, Switzerland; Frankfurt, Germany; and London, England; in a multi-jurisdictional effort, agents worked closely with authorities overseas to identify cases that could be prosecuted.

As a result of the OPFOPEN probe, numerous cases were prosecuted in the United States and Europe, including a dozen individuals being “indicted” by separate Federal Grand Juries [FGJ], in Louisville, KY and Memphis, TN attempting to defraud $5.5 million from six U.S. banks, using fraudulent securities issued by KITZER, doing business as [dba] Seven Oaks Finance Ltd, in Kent, England.

With respect to the investigations conducted in Memphis, agents said during the undercover phase of the investigation ALFREDO PROC, aka Freddie Pro admitted swindling ELVIS PRESLEY’s Lockheed JetStar and later using it as collateral in another scheme. Meeting in New York—shortly after PRESLEY’s death—PROC admitted his role in the scam telling undercover agents, “Wheels-up,” he telephoned KITZER using the plane’s sky phone bragging he took the jet. Acknowledging the call, KITZER agreed PROC took the jet.

Later, agreeing to cooperate in the OPFOPEN investigation, both KITZER and PROC pled “guilty” to federal violations in exchange for 10-year prison sentences, resulting in numerous individuals being convicted on both racketeering charges and White Collar Crime. Contrary to press reports speculating about PRESLEY’s involvement, agents said he did “not” know about the undercover investigation and was never an undercover operative. Acknowledging his trial testimony, agents said VERNON PRESLEY cooperated in the investigation which was covered by the local news media. They also said the case helped spawn the ABSCAM investigation.